Restaurant Pos - The Facts

Restaurant Pos - The Facts

Blog Article

The Single Strategy To Use For Point Of Sale Systems

Pos System for Small Business: Retail Point-Of-Sale Solutions Streamline Deals

Pos Machine - Questions

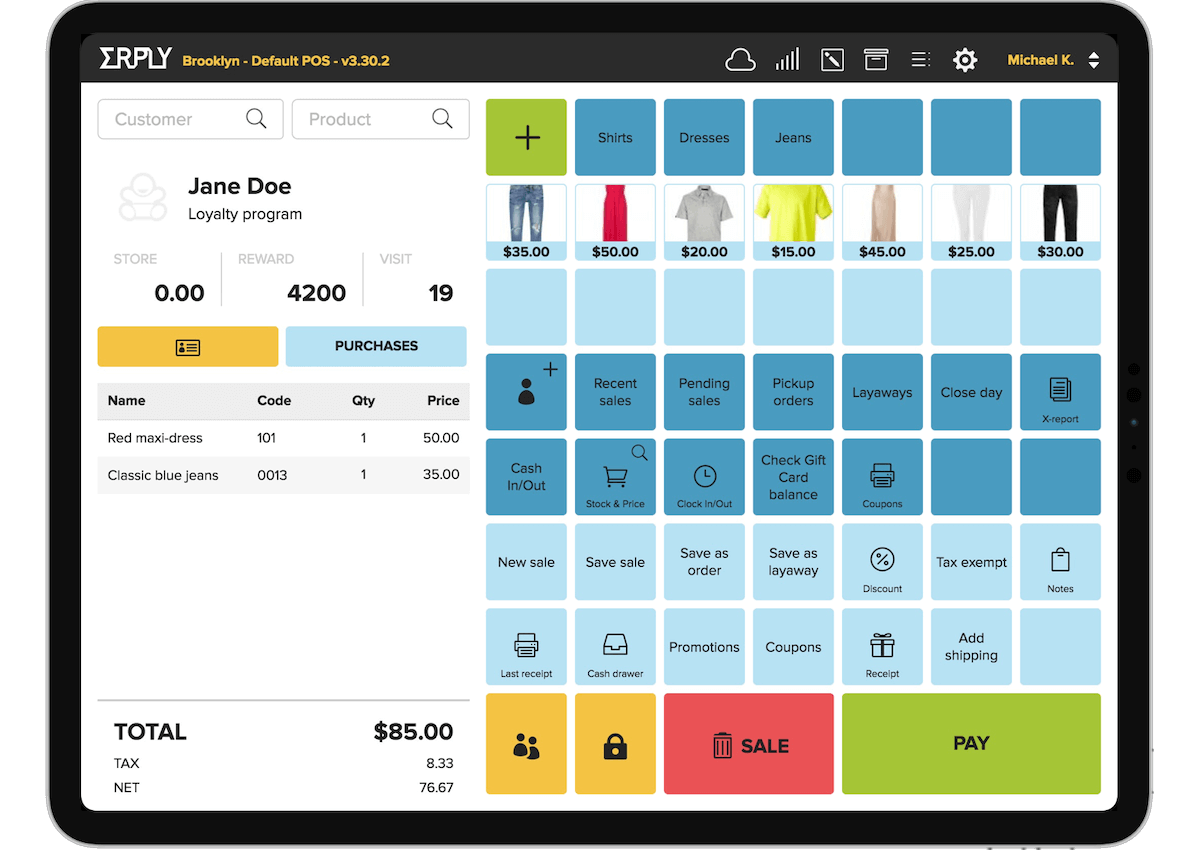

Hardware Components of a Point of Sale System What makes a POS system tick? It's not just software; the hardware plays a starring role. Think about it as the body to the software's brain. Without the right hardware, even the most sophisticated POS software is just a pretty face. Necessary POS Hardware So, what are the must-haves? Let's break it down. The main processing system, often a computer or tablet, is the heart of the operation. The display or touchscreen show enables staff to engage with the system. A barcode scanner speeds up the checkout process. Keep in mind the days of by hand entering each code? The trusty receipt printer offers customers with a record of their purchase. A money drawer keeps your money safe and organized. A card reader allows customers to pay with credit or debit cards. Diving Deeper: Beyond the Fundamentals However wait, there's more! Depending upon your business, you might require specific hardware. A dining establishment might integrate cooking area printers to relay orders, while a retail shop may use label printers for item tagging. Ever question how your regional pastry shop quickly read more prints those delicious-looking labels? Choosing the Right Hardware: A Balancing Act Choosing the right hardware isn't practically buying the most costly devices. It's about discovering the sweet spot between performance, durability, and budget. A little service just starting might go with a more standard setup, while a high-volume merchant will need robust, high-performance machines. Is it better to purchase new or utilized? Consider your choices carefully. A brand-new system provides the current innovation and warranty security, however a reconditioned system can save you cash. The Future of POS Hardware What does the future hold? Expect to see much more combination with mobile phones, biometric scanners for employee authentication, and advanced analytics dashboards displayed on larger, clearer screens. Imagine a world where stock is immediately updated in real-time as products are scanned-- a world where you can track your very popular product from throughout the world. The possibilities are unlimited, and the hardware is constantly developing to meet the needs of today's companies. Are you all set to upgrade your point of sale system?

Software Features and Capabilities: The Heart of Your POS System

Ever see an experienced barista slide through a hectic morning rush? Their trick isn't just caffeine; it's a smooth dance with their POS system. The software application is the conductor of your business symphony, managing everything from sales to stock. But what notes should you be listening for? What abilities really matter in today's market?

Stock Management: Beyond Counting Beans

Forget spreadsheets that haunt your dreams. Modern POS systems use real-time inventory tracking, informing you when your stock of artisanal coffee beans dips precariously low. Think of it as a digital guardian angel, preventing those awkward "Sorry, we're out!" moments to customers. What if you could also forecast need based on historic information? Numerous systems now use forecasting tools, a powerful weapon against overstocking and lost sales. This assists prevent the dilemma of running out of popular items or building up excess stock of slow-moving items, both of which can constrain capital and area.

Sales Reporting and Analytics: Deciphering the Data

Sales information is the brand-new gold, and your POS system is the miner. Forget feeling in one's bones how much you sold today. Dive deep into the data to uncover trends, identify your best-selling products, and understand customer habits. Which menu product sets completely with the day-to-day special? Which promotion resonated most with your clients? These insights are not just interesting; they're actionable intelligence. Without trusted sales reporting, navigating the intricacies of organization decision-making ends up being like cruising without a compass, increasing the possibility of missteps and missed opportunities.

Consumer Relationship Management (CRM): Structure Bridges, Not Walls

Keeping in mind a regular customer's name and favorite order is captivating, but scaling that personal touch is tricky. POS systems with CRM capabilities allow you to track customer purchase history, preferences, and even birthdays. Picture automatically providing a discount on their birthday-- a little gesture that fosters loyalty and encourages repeat business. There is the potential snag of poor information quality, which can lead to unreliable consumer profiles and inadequate marketing efforts.

Payment Processing: Improving the Deal

The checkout experience can make or break a sale. Seamless combination with numerous payment methods-- charge card, mobile wallets, even copyright-- is non-negotiable. Can your system manage split payments? Does it use protected tokenization to protect customer information? A cumbersome payment procedure is like hitting a sour note in your organization symphony, potentially disrupting the entire performance. Making sure compatibility with progressing payment technologies and adherence to security requirements are paramount for preserving client trust and operational performance.

Staff Member Management: Keeping the Team in Sync

From clocking in and out to managing authorizations and tracking efficiency, employee management includes enhance operations and enhance accountability. Is scheduling a nightmare? Many POS systems provide incorporated scheduling tools, enhancing staffing levels based upon forecasted demand. A common obstacle that is often overlooked is the obstacle of integrating worker management performances with payroll systems, which can lead to mistakes and ineffectiveness in wage computations.

Advanced Features: Leveling Up Your Operations

- Table Management: Ideal for dining establishments, this feature enables you to imagine your dining-room, track table status, and handle reservations.

- Commitment Programs: Reward your finest consumers and motivate repeat service with integrated loyalty programs.

- Online Buying Combination: Effortlessly integrate your POS system with online ordering platforms to broaden your reach.

Choosing the best POS system has to do with more than just performance; it's about finding a partner that can grow with your business. Consider your existing needs, anticipate future development, and don't hesitate to ask the hard concerns. The ideal software can transform your organization from a disorderly cacophony into a harmonious masterpiece.

Industry-Specific POS System Applications

Consider the local bakeshop, dynamic with early morning clients yearning fresh croissants. A generic POS system might deal with deals, however can it handle intricate recipes, track ingredient inventory, or immediately change production schedules based on sales data? Probably not. That is where the beauty of industry-specific POS systems shines.

Dining establishments and Hospitality

For dynamic dining establishments, speed and precision are critical. How lots of times have you seen servers managing orders, adjustments, and splitting expenses, all while trying to supply excellent service? A dining establishment POS system enhances these processes, allowing for table management, kitchen area order tickets, and even online purchasing combination. These systems frequently consist of features like ingredient-level stock tracking, essential for managing food expenses and minimizing waste. Ever wonder why your favorite dish is in some cases not available? It might stem from a lack of proper stock management.

- Table Management

- Kitchen Area Order Tickets

- Online Ordering Combination

- Ingredient-Level Inventory Tracking

Retail Solutions

Retail, with its varied inventory and client interactions, requires a different set of tools. Picture a shop clothes store struggling to keep an eye on sizes, colors, and seasonal collections using a fundamental checkout system. An industry-specific retail POS system offers functions like barcode scanning, customer loyalty programs, and detailed sales reporting. These systems can even integrate with e-commerce platforms, providing a seamless omnichannel experience for consumers. Did you know some retail POS systems can anticipate future sales patterns based on historic data? Now that is powerful!

The Dangers of an Inequality

Selecting the wrong POS system can develop substantial functional difficulties. A clothes store using a dining establishment POS, for example, would find it inappropriate for managing stock with sizes and colors. The lack of appropriate reporting and analytics might cause mistaken acquiring choices and lost income. The result might be similar to trying to fit a square peg in a round hole.

Key Considerations

Selecting an industry-specific POS system needs careful assessment. Believe about your organization's special requirements and operational workflows. Does the system incorporate with existing software? Does it use the essential reporting capabilities? Is it scalable to accommodate future growth? A well-chosen POS system is not simply a transaction tool; it's a tactical asset that can drive efficiency, enhance customer satisfaction, and eventually, enhance your bottom line. Remember, it is a financial investment in your service's future, not simply an expenditure.

Security Factors To Consider for Point of Sale Systems

Ever heard the tale of the mom-and-pop store that lost everything due to the fact that of a single, neglected security flaw in their POS system!.?. !? It's a cautionary tale, and it highlights a crucial element frequently overshadowed by the allure of fancy functions and structured operations. The truth is, a POS system is just as great as its security. What excellent is a system that crunches numbers in a flash if it enables wrongdoers to swipe client's information simply as quickly?

The Vulnerability Minefield

The digital landscape is a battlefield. Every POS system, no matter size or sophistication, is a potential target. Are you genuinely got ready for the threats lurking around the corner? The genuine pinch comes when you find that your out-of-date software application has a gaping hole that hackers can exploit, turning your service into an unwitting accomplice in identity theft. The trouble is that hackers are crafty and are constantly changing their techniques.

Common Security Spaces and Specialist Tips

- Weak Passwords: "Password123" isn't sufficing. Usage strong, special passwords for all POS system accounts and alter them routinely. Two-factor authentication is a must.

- Unsecured Networks: Your Wi-Fi is like leaving the front door open. Protect your network with strong file encryption (WPA3 if possible) and consider a different network for your POS system.

- Out-of-date Software Application: Software application vendors spot security holes all the time. Stopping working to update resembles inviting trouble. Establish automatic updates or schedule routine maintenance.

- Employee Training: Your personnel is your very first line of defense. Train them to acknowledge phishing attempts, secure passwords, and report suspicious activity.

Data File Encryption: Your Guard Versus the Dark Arts

Think about information file encryption as a secret code. It scrambles sensitive details, like credit card numbers, making it unreadable to unauthorized users. Without encryption, your consumers' monetary information resemble sitting ducks, ripe for the selecting by cybercriminals. It's not practically protecting your consumers; it's about protecting your reputation and preventing substantial fines.

PCI Compliance: The Rulebook You Can't Ignore

If you accept credit cards, you're bound by the Payment Card Industry Data Security Standard (PCI DSS) It's a set of security requirements developed to secure cardholder information. Stopping working to comply can lead to fines, charges, and even the loss of your ability to process credit card payments. It's a headache, yes, but it's a needed one. Consider PCI compliance as the expense of doing organization in the digital age.

Consider this: every transaction processed through your point of sale is a possible entry point for harmful stars. By executing robust security steps, you're not just securing your company; you're protecting your consumers' trust and ensuring the long-term practicality of your operations. The security of your POS system isn't just a technical issue; it's a company imperative. It needs consistent caution, proactive steps, and a commitment to staying ahead of the curve.